As the first half of this rather forgettable year is now done many of my clients are yearning to know when this volatile period is expected to end. If I was a lawyer, I would answer it in a simple way: it depends. But I’m not a lawyer (much to my parents’ disappointment) … so I suppose we will have to agree to using some probabilistic analysis as to when this mishigas will end. Having read my various commentary over the years, you probably are expecting me to go full blown analog on you and inundate you with data and historical analysis. Of course, the problem with finding historically similar periods as they relate to our current environment is that we simply have not seen anything like this in the last 50 years. Ah, but fear not my avid readers … I will dust off my economics textbooks and try to predict where things may wind up towards the end of the year.

The first issue at hand is defining where we are in the economic cycle; are we late cycle, or are we early recession? If we wait for the official score from the National Bureau of Economic Research (“NBER”) we may miss the next great bull market while they opine as to whether we entered or exited a recession. I will save you the suspense of having to wait another year for those officials to bless our current cycle with their nomenclature. My sense is we have entered a consumer led recession beginning in early 2022. Yes, you heard it here first … we can now use the dreaded “R” word to describe the current environment. For many reasons that we have already discussed in other articles, the rate of inflation increased to levels that became decidedly detrimental to consumption. According to the Bureau of Labor and Statistics, Americans began experiencing enormous financial hardship as real wages fell by 3% as measured by the year ending May 2022. (Real wages are defined as wages adjusted for inflation). And now that it appears that job growth is about to stall, I suspect that wage growth will also begin to falter. This is truly a recipe for lower consumption – we are already seeing that in the official 1Q 2022 GDP data recently released, showing that rea1 personal consumption in goods for the last three quarters have declined on average at an annualized rate of -0.67%. This means that consumers are buying less goods with their hard-earned money – that is the stuff of consumer led recessions.

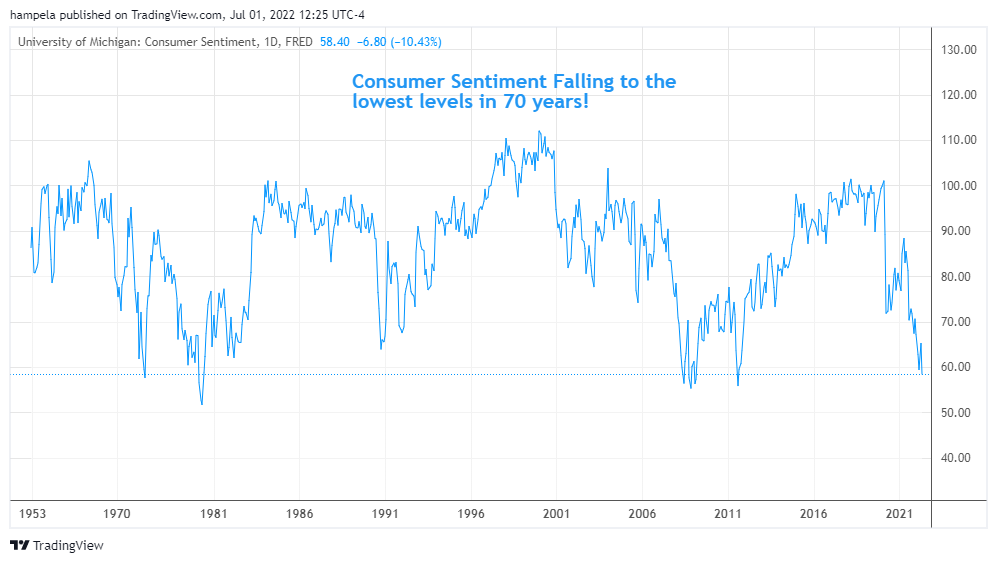

The US consumer regardless of the GDP numbers or the massive job gains has been struggling for nearly a year now. My economic thesis is that falling real wages are highly correlated with consumer confidence. To prove my point, look at the following graph of University of Michigan consumer sentiment data which shows consumers feeling about as bad as they have ever felt in the last 70 years:

Throughout the pandemic recovery and the torrid pace of job growth, consumer sentiment has fallen precipitously. People in the US and globally are feeling a lot poorer because the pace of inflation has eroded their purchasing power. As I have written in the past, the most important job for this central banking leadership is to maintain a low and predictable pace of inflation. Many central banks around the globe are finally raising interest rates and reducing financial quantitative easing to combat high inflation. In the words of Federal Reserve Chairman Powell, “we have to lower demand to more closely be balanced with supply.” And then the Fed raised interest rates by 75 basis points on one day, the largest such rise since 1994. Furthermore, the Federal Reserve is communicating that they may be equally as aggressive in their next meeting on July 27th. These policy makers are incredibly up front about their intention on lowering inflation – and it is my opinion that they will succeed.

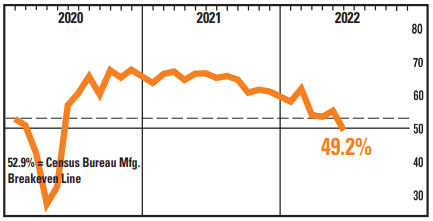

The first order effect of all these aggressive monetary policy actions is to reduce access to cheap money that can drive debt financed purchases, such as homes and cars. As consumers buy fewer durable goods, the inevitable prices of those goods will hopefully come down. The GDP report showed that Americans are already reigning back their spending on durable goods and the most recent ISM Manufacturing report showed that New Orders for those goods are now contracting.

This is a graph of the ISM New Orders Index breaking below the 52.9% breakeven line:

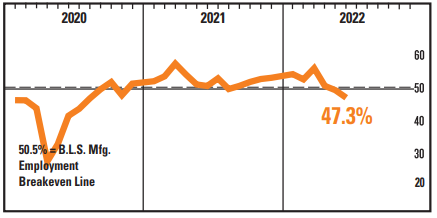

One of the unfortunate casualties of restrictive central bank policies will be job growth. Because if people buy fewer durable goods, companies that sell those goods will need less people to make them and thereby less people to distribute them. I suspect we will begin seeing job losses in the manufacturing sector in the next several months. We are already seeing layoff announcements in the banking sector as mortgage origination has all but dried up on the back of the massive runup in mortgage interest rates. That is a leading indicator for weaker housing demand. When it comes to manufacturing, housing is an important driver of that jobs sector. Look at the employment component of the ISM Manufacturing Report published on July 1, 2022, which shows that we are now well below the 50.5% Employment Breakeven Line:

Conclusion:

I suspect that the inflation rate will begin to peak relatively soon, simply because the economy is slowing down, and people are carefully avoiding large durable goods purchases. As China reopens its supply chains and demand for goods continues to erode, I could envision inflation dropping exceptionally quickly. And if somehow, we could imagine the end to hostilities between Russia and Ukraine the price of energy and many industrial commodities could literally implode. And voila, you have a recipe for an abrupt ending to the interest rate hiking cycle. We might even be talking about lowering rates by the start of 2023. If that were to happen – oh how the growth darlings will once again rule the roost. But for now, remain patient and defensive … the Russia-Ukraine Conflict is the big unknown in the thesis.