Have you ever been asked by your child an adult question and found yourself searching for the right answer? I usually start the answer with the classic, “well, it’s complicated.” But every once in a while, I find it useful to go through the process of answering that tough question just to see if I actually have a grasp of the material myself. So, there I was yesterday morning, enjoying breakfast with my son and he asked me a rather simple question: “Hey Dad, what’s the deal with all this rate hike stuff?” At first, I thought to myself that it is rather unusual that a sixteen-year-old boy is concerned with the Federal Reserve and the global economy. But then I centered my thoughts and focused my attention to the question at hand. I found myself delving into the topic, trying to explain to a high school kid why all this really matters and how it might affect society as a whole.

My avid readers know by now that I am an economist in portfolio manager’s clothing. Therefore, my explanation will require some background before we get to the skinny of it all. The “rate hike stuff” as the teenager called it, is really a result of years of bad government policy. Ever since the 1980s we have been amassing mountains of debt to run our public sectors. We borrowed heavily to fund the Cold War. We borrowed heavily to fund entitlement programs. We borrowed heavily to shore up the healthcare system. We borrowed heavily to bail out the banks and auto manufacturers during the 2008 Financial Crisis. And in 2021/22 we borrowed enormously to fund PPP loans and Pandemic related bailouts. And if the President has his way, we will be borrowing heavily to retire student debt. All that borrowing and decades of deficits have created an environment where regular folks became somewhat profligate with their spending habits. And the Federal Reserve made this all possible by keeping interest rates near zero for the better part of 13 years. Mortgages got down to near rock bottom levels, car loans were issued at 0%, and government policy made it acceptable for renters to stop paying rent due to Pandemic hardships. When interest rates stay near zero for more than a decade, and when taxpayers are provided tax cuts, this all translates to excess consumption. The data is clear: when Americans get more money, they usually spend most of it and save very little of it.

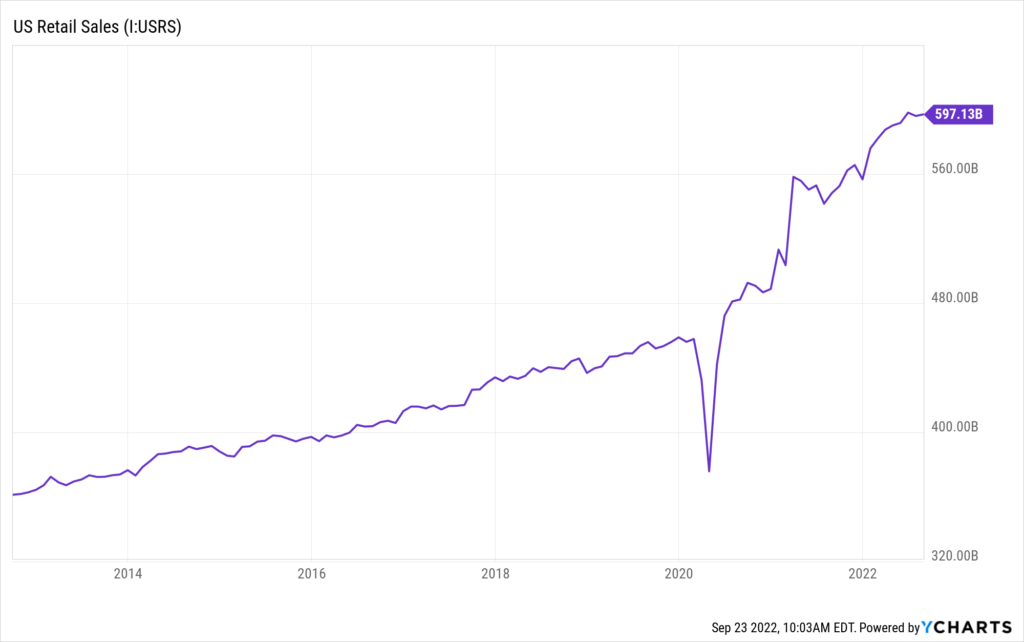

All this excess consumption would have been a problem for any economy. But, when governments began handing out free money to ordinary citizens, those people decided they better go out and buy stuff. As you can see from the chart below, consumption went bonkers over the last several years. Retail Sales skyrocketed, from a monthly trend of $446 billion to almost $600 billion. Some of this can be attributed to inflation … but the math clearly shows that when the US government handed out more than $2 trillion in checks to the populace, they went out and increased consumption by nearly $2 trillion.

The main problem with all this consumption is that it was happening exactly at a time when supply chains were shattered by the ongoing Pandemic. Nearly every economy in the world was social distancing due to Covid restrictions, while the consumer was online shopping for electronics, automobiles, and even houses. Our newly created Zoom economy put a zoom on the pace of consumption. And with excess demand and limited supply we began to see prices rise for everything. Couple that with a war in Ukraine, and oil and commodity disruptions, and the groundwork for an inflationary cycle had been put into overdrive.

A quick note on inflation is in order: inflation works with different lags for different things. Commodities inflation is scene almost in real time, for when factories reopen and see a rapid increase in new orders, they move quickly to secure upstream commodities that they will require to ramp up production. Oil prices react quickly, as do industrial metals and building supplies. This could be seen playing out in the commodity indexes as consumers quickly increased their spending. Take a look at the chart below, which is the Bloomberg Commodity Index. It shows that from December 2020 to June 2022 prices for industrial commodities increased by 76%!

And as commodities go, so do consumer prices. Again, the name of the game here is constrained supply chains being hit with massive demand for products, while at the same time experiencing oil and gas shortages brought about by structural underinvestment in energy production and reliance on easily disrupted suppliers, like Russia and OPEC. It is confounding that the entire European Union had become reliant on an unstable regime to supply itself with energy; history had already provided ample evidence that Russia was not the ideal partner for business dealings. In a word, the world economy had literally been hit with the perfect storm.

While all these supply chain problems were materializing, central bankers made a calculated bet that eventually the labor market will return to normal and that factories will reopen. Recall the description of inflation by the Federal Reserve as being “transitory?” Government officials were convinced that all this imbalance would correct itself as the Pandemic dissipated. People would go back to work, the government free helicopter money would stop filling up bank accounts, and factories would reopen. The excess demand was supposed to gradually wane, while at the same time the supply chains would reopen and expand. Voila: demand would be in balance with supply, and we could all go back to normal again.

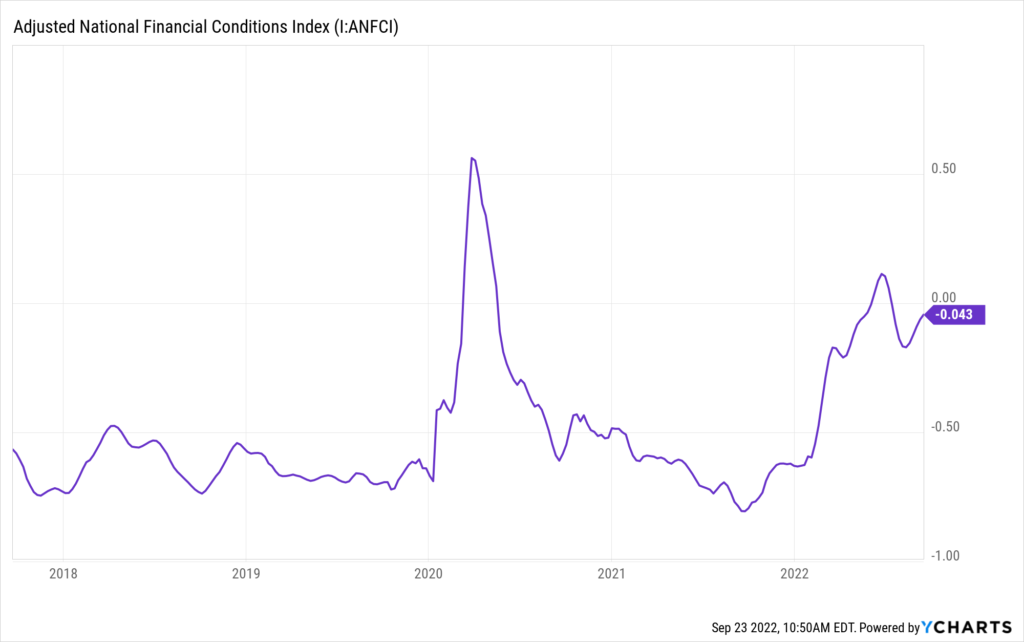

Yet the old normal seemed to have morphed into a post-Pandemic new normal where labor shortages are persistent due to a permanent shift in the labor force. Labor had mysteriously vanished: people dropped out of the work force due to retirement or work from home choices. Fast forward to late 2021 – the Federal Reserve began to hint that perhaps this “transitory” thing wasn’t exactly going to be short lived. They decided to change their opinions and removed that dreaded word. In my opinion they realized that consumer behavior had changed as a result of the Pandemic. And once you realize that your economic model is no longer appropriate for a new normal, you need to rapidly change the model. As a result, after much introspection, and in various public speeches, the collective central banking world has realized that they have absolutely no control over supply chains. The flawed narrative had to be recalibrated and the Federal Reserve decided that given the extremely high levels of inflation, they had to act fast to stop excess consumption. That meant Chairman Jerome Powell had become convinced that lowering demand was the only way to stop the inflationary cycle. The Fed has several tools at its disposal to achieve this goal: it can raise the cost of borrowing, it can decrease the amount of money in the banking system, and it can tighten financial conditions. This is exactly what they have been doing; take a look at the following chart as it measures the financial conditions index:

The move higher in 10yr rates, mortgage rates, credit spreads, and lower stock markets work to tighten financial conditions. This in theory should translate to lower economic activity – which means lower demand for consumption. If these “tighter” conditions persist, companies will begin to cut back employee hours and eventually even lay off workers. This is exactly what the Fed wants to achieve – but they are hoping it will be gradual and culminate in a soft landing.

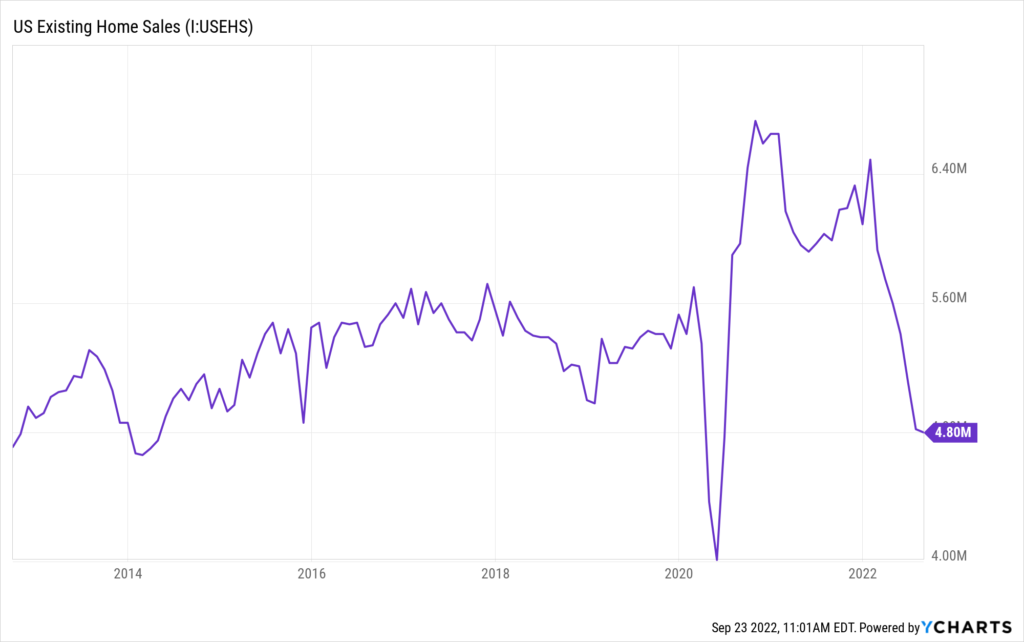

In this week’s Federal Reserve press conference, Powell communicated in no uncertain terms that the Committee is focused on lowering inflation, and they are moving aggressively to achieve that outcome even though it may result in a recession. I am convinced they will be successful in both the endeavor of lowering inflation and in achieving a recession. The data is already showing rapidly declining commodity prices and consumption indicators are beginning to slow down, or even contract somewhat. Mortgage rates have tripled from 2.25% to 6.75%, resulting in a collapse in home buying activity – existing home sales volumes have declined nearly 30% as a result of the move in rates:

Prices of homes have also begun to drop, and some are estimating further declines that could see prices fall by up to 20% in some parts of the US economy. What had become a sellers’ market just a year ago has quickly morphed into a buyers’ market and some may even characterize it as a buyers’ strike. Another piece of data that is immeasurably important is the price of oil, which has declined rapidly as investors are expecting oil demand to fall due to lower economic activity. Look at the following chart of oil – crashing nearly 40% in a few months:

It has always been my opinion that the US economy is built on three legs: cars, houses and technology. These constitute large ticket items in our consumption patterns. The Fed has achieved the housing part of the slowdown. Automobiles continue to be supply constrained and have a backlog of demand due to years of supply chain disruptions. However, automobile prices are beginning to falter now that rates have risen, and consumers are having trouble with loan affordability. As for demand for technology, it will be driven by both retail consumption and corporate consumption. It appears corporate consumption is becoming somewhat restrained due to the approaching recession. Companies are reigning in spending and announcing early cost reductions to support earnings. If and when they begin to lay off workers, I would expect somewhat slower technology spending.

So … back to the original question at the outset of this article: what’s the deal with this “rates stuff?” The deal is unfortunately a bad deal for portfolios in the short run, but a much better deal for portfolios in the long run. Having inflation run rampant is a horrible tax on your wealth as it erodes consumer purchasing power. Companies are unable to plan their investment initiatives. And, most importantly, it is societally destabilizing. The central banks are doing us all a very big favor by shoving the inflation genie back into her bottle. My early onset indicators, like housing, oil and commodities, are flashing recession. They are telling me that the rate increases have already worked extremely effectively. Now we await the data to support the view that the goal of whipping inflation has been achieved. We should begin to see that in the very near term. As I wrote in my last Market Update on September 13th, I expect the Fed will stop the hiking cycle at approximately 4.00-4.50%. This is now baked in the cake. I expect the rate hikes to most likely end on December 14th, 2022. This has been an extremely challenging year for stock and bond investors. Although the volatility is still a part of our daily lives, once the Fed is done with the rate hikes, we should begin to see the start of a meaningful and more lasting rally. And if the market becomes convinced that the inflation story is moving in the right direction we may begin to see that rally start even sooner.