Beware the Ides of March

It has finally happened. The global hiking cycle has finally reached the banking sector. We can pontificate about risk management shortfalls at regional banks in the US and how the regulators utterly missed the mark when it came to overseeing Silicon Valley Bank (“SVB”). But this problem has been brewing since the 2008-2009 Great Recession.

If you’ve read my articles before, by now you know that I am a history buff. So, without further ado let us dive into a quick synopsis. In response to the Great Recession, central banks on a global scale slashed interest rates to zero, and some to negative, to revive growth. Furthermore, they printed trillion of dollars and embarked on quantitative easing (“QE”) to resuscitate moribund and anemic economic activity. At the onset of the Great Recession, unemployment was rampant, and businesses were struggling to remain solvent, bringing a toll of untold hardship to millions across the globe. The big fear was that the credit bust of 2008-2009 would manifest itself into a period of deflation. Deflation is a central bankers worst fear because it effectively increases the real debt load of private businesses and governments. It can last for many years and people are disincentivized to buy goods today, because they expect prices to fall. Companies do not invest today, because it will be cheaper to do so in the future. Businesses put off hiring needs because they expect wages to fall. It is a spiral of negativity that can last for decades. The playbook for such a risk is for central banks to lower rates, print money and buy assets with that money in the hopes of incentivizing businesses and people to spend more money, thereby pulling economies out of the doldrums and back into growth mode.

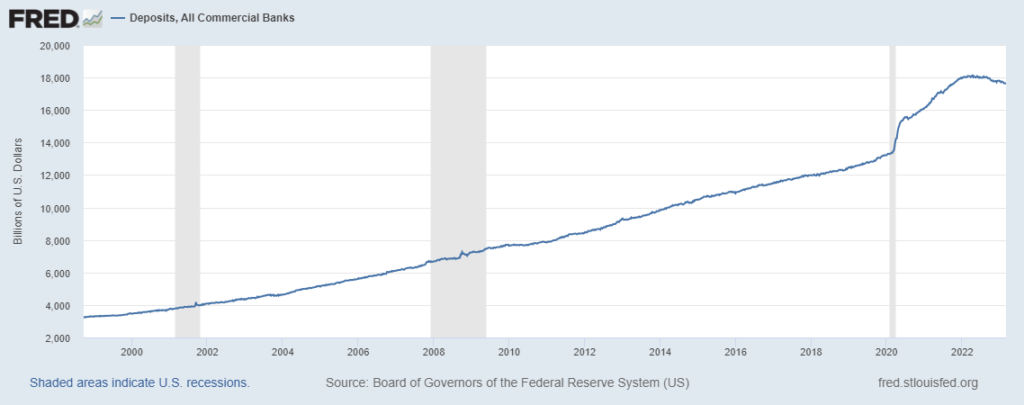

During the 2009-2021 business cycle, interest rates stayed at near rock bottom levels. Banks, who take in deposits, generally try to make loans with that money and often times buy marketable debt securities to earn returns on the deposits. Since deposits tend to grow at a predictable pace, these investments also grow at a measured pace. But when the Great Pandemic of 2020 arrived, fiscal authorities took easy money to a completely new level. Again, fearing an economic collapse, central authorities decided that they needed to provide monetary relief in the form of PPP handouts and EIDL loans. Governments around the globe (but mostly in the US) literally handed out free money and placed it in people’s checking accounts (deposits). This was done almost overnight. Suddenly, banks saw a massive increase in checkable deposits on their balance sheets. And as bank do, they had to find a quick way to invest all that money. Prior to the Pandemic there were roughly $13.5 trillion in deposits at banks. In just two years, that grew by an earth shattering $4.6 trillion, or a 34% increase in deposits. Banks literally were forced to buy all kinds of assets to put that money to work, including treasuries, mortgage securities, and corporate bonds. All that buying happened at really high prices and very low yields. And banks put a lot of those investments into Held-to-Maturity (“HTM”) balance sheet accounts, which permitted the banks to value them at the original purchase price of those assets. Below is a picture of the rapid increase in bank deposits over the last several years (notice the massive jump in the last several years):

None of this was a problem, until the Federal Reserve began the most aggressive interest rate tightening campaign since the 1980s. This caused a massive drop in the fair market value of all bonds – but the bonds in the HTM portfolios were still being marked at original purchase prices. This is an accounting gimmick that permits banks to “match” long term assets against long term liabilities. As long as the liabilities are going down in price at the same pace as the assets, no harm no foul. But if the liabilities are overnight deposits, we now have a classic asset-liability mismatch. This is still not “technically” a problem … unless … people want their deposits back. Banks target the Aggregate Bond Index as an investment comparison. Below is a picture of the value of the Aggregate Bond Index over the last several years as a result of the Fed hiking cycle (Loss of 22%):

Let’s fast forward to March 10, 2023. By now you all know that SVB was a terribly run institution, mismatching its balance sheet, and relying on uninsured deposits to fund long term bets on low interest bonds and even crypto. And when interest rates rose it caused those bond bets to lose their value. SVB did not hedge those bad bets and just held the bonds in the HTM account where they valued them at original face value. Eventually when large depositors pulled their money, the bank was forced to sell those bonds at steep losses. Voila – the SVB was “bankrupt.”

The Federal Reserve and the FDIC should have seen the writing on the proverbial wall. One might say, “duly noted – lesson learned.” But to permit SVB to run the equivalent of a gambling operation with depositor-based funding is squarely on the regulatory authorities. This was basically central banking malpractice. Where were the balance sheet stress tests? Why didn’t the FDIC recognize that SVB was using overnight demand deposits to make ten year interest rate investments? I suspect that there will be countless hours of Congressional testimony of regulators and bank CEOs in the coming months to rehash what my ten year old already knows – you cannot run a bank without proper supervision.

In my estimation the entire financial sector will now experience a new regulatory push similar to the Dodd-Frank Act of 2010. As we currently stand, there are approximately $8 trillion in checkable deposits sitting on bank balance sheets. A lot of this money has been used to create mortgages, auto loans, student loans, etc. But a good share of this money has been used to buy bonds in the open market and place them in the HTM portfolios of many banks. My back of the envelope estimate is that there could be upwards of $500 billion worth of HTM losses on bank balance sheets, that if held to maturity will essentially not matter whatsoever. But if uninsured depositors start moving from one bank to the next than the original bank will run into some trouble – it will have to sell those under water bonds at a loss and realize the losses. This is exactly why the FDIC is formulating a plan to insure ALL deposits. If all deposits are insured than there is very little reason to ever move your money to another bank. And if the FDIC does that, they will have to increase the FDIC insurance premiums that banks pay on a yearly basis.

Now let’s get into the weeds a bit to gain an appreciation for what all this means for the financial sector as an investment vehicle. The FDIC stands for the Federal Depository Insurance Corporation. It acts as an insurance policy for your hard-earned deposits. In the event that a bank runs into trouble, your money is good, and the FDIC will give it to you as if nothing ever happened. This prevents bank runs the likes we saw in the Great Depression in 1929. But someone has to pay that insurance premium, and as it currently stands banks on average pay about 0.20% of there deposits as an insurance payment to the FDIC. As it currently stands, that premium is meant to protect only the insured depositors up to $250,000 per person. If the FDIC was to be tasked with insuring all the other deposits, they would have to charge more than 0.20%. The math is rather simple – more insured balances will require higher premiums. My guess is that the FDIC will probably double that premium to around 0.40%-0.50%. That will cost an additional $21 billion per year of bank profits. Since banks “only” make $140 billion in profits per year, this will reduce that profit by some 14%, forever. In addition, I expect that stress testing will be required of nearly any bank with more that $50 billion of assets (currently only the very largest banks are required to extensively stress test their investment portfolios). Stress testing is expensive and time consuming and requires many highly paid mathematicians and risk managers to properly accomplish. My guess is that this too will cost banks an additional chunk of money. And all those pesky unrealized losses on bank HTM portfolios – many banks will have to probably raise some capital to shore up the balance sheets. They will have to add some longer term debt and may be even some secondary equity issuance. All in all, it appears that the entire banking sector should probably be worth between 15%-20% less than it did before the SVB disaster. Don’t fret though – I am positive that banks will just raise many fees to try to offset some of those losses. They may even have to suspend equity buybacks, and some may even eliminate shareholder dividends. In a word, everyone will participate in the solution. Consumers will pay more to bank, investors will lose money on their bank stocks, and banks will pay more to be in business.

The reason I bring this to light is twofold. First, I think it is an important public service to help my investors understand what happened and why it is happening. Investing is complicated stuff and requires a deep understanding of how companies make money. As investors it is imperative for us to have “confidence in the system.” By understanding what’s at stake and how problems can be addressed I hope to impart some much needed confidence that even though the present is somewhat cloudy, the future will bring better weather. Finally, it is also vitally important to have an appreciation when something major happens that will have a lasting impact on how portfolio managers allocate capital. Recall that the Exxon Valdez brought about new regulatory requirements for shipping oil? Or remember the BP Gulf disaster that brought about much needed regulations for sticking big pipes full of petroleum in our oceans? Dodd-Frank went a long way to permanently improve the capital positions and pair back risk in the financial sector. This time is no different as the unfinished work must and will be addressed to provide us with an even more sound banking system. For now, though, be prepared for a bumpy ride.

One last note: if the Federal Reserve raises interest rates next week it might be one of the most out of touch central banking decisions in history. When credit spreads are widening, and the soundness of banks is being questioned now is not the time to tighten monetary policy. This last week has acted as a large contractionary economic event. Banks will not be eager to lend out money. Businesses will find it more difficult to acquire financing. And consumers will find it somewhat more challenging to get home and auto loans. Perhaps it is high time for the Federal Reserve to pause its hiking cycle and see where the chips fall. And if they should fall too hard, we may have to consider easing policy before long.