These are Simple Times

I realize you might be shocked at my interpretation of the state of play in today’s investment climate, but I urge you to read on and consider the wonders of simplicity. Once again, we are faced with reaching the Congressionally mandated debt-limit for the US Federal government. Given the profligate spending of the last several years we have accelerated our debt accumulation to levels unimaginable since the Obama Administration. Recall that in 2011 President Obama faced staunch Republican opposition to advancing a new budget immediately after ceding control of Congress in the 2010 midterm elections. At the time the US Treasury had amassed a whopping $11.667 trillion in debt, and all were aghast at the massive amount of liabilities accumulated in Obama’s first term in office ($4.291 trillion in just three years). It became clear to investors that the fight for budgetary control was the real deal – and Obama, with the help of his talented advisers, quickly decided that the fight was not worth having, especially when the stock market dropped 17% in a mere two weeks in late July 2011. The two sides agreed on a continuing resolution to raise the debt limit for several months to permit time for everyone to negotiate in good faith. Voila! Problem solved – new budget, debt ceiling raised, economy saved. Of course, unlike the current administration, Obama did not wait until just weeks before the zero hour. This was done several months prior to the approaching date of US government default.

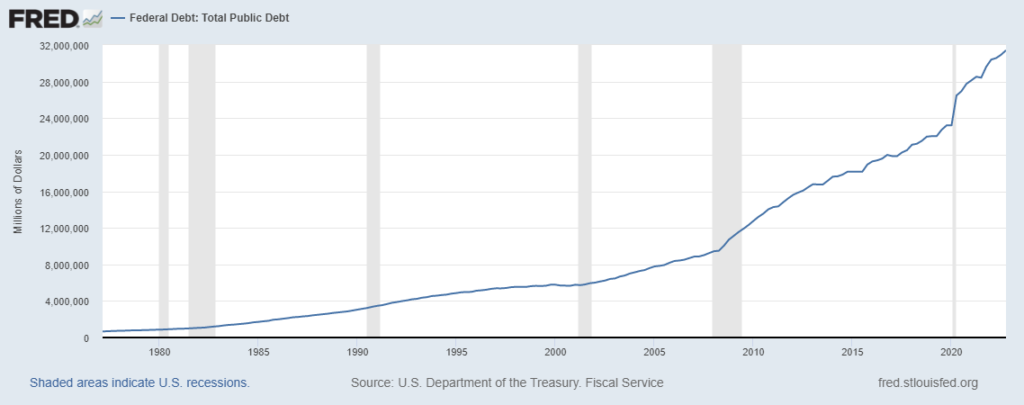

Now let us fast forward to today. Similar to the 2011 period, the current administration has ceded control of the House of Representatives to the Republicans. In addition, the US is currently sitting on a mountain of debt of roughly $31 trillion (Look at the graph below) – nearly $20 trillion of debt has been amassed since the “spendthrift” days of Obama. I literally laughed out loud and cried simultaneously at the preposterousness of the amount of debt we have amassed in just 12 years.

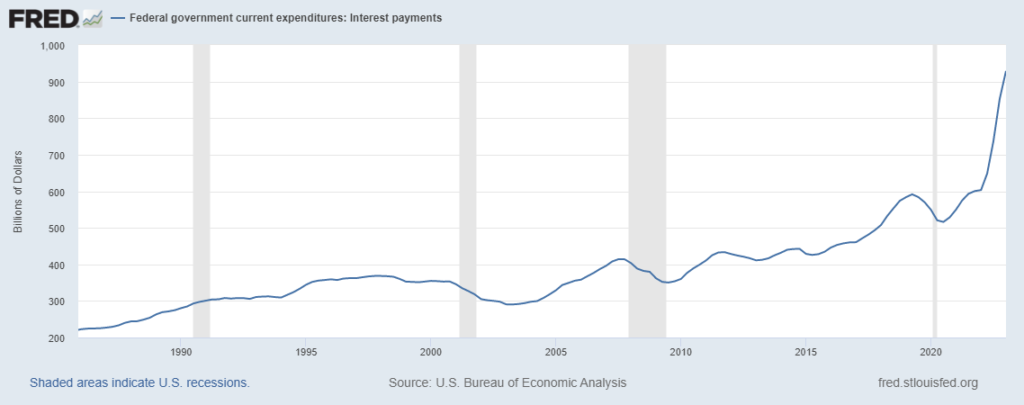

What is abundantly clear is that at these levels of Federal debt we are going to require a lot more debt just to pay the interest payments on our existing stock of debt. If the US were to magically balance the budget, the Federal government would have to pay more than $1.24 trillion per year just on the interest on our debt (assuming 4% interest rates). The chart below shows the growth in annual interest payments liabilities of the Federal government.

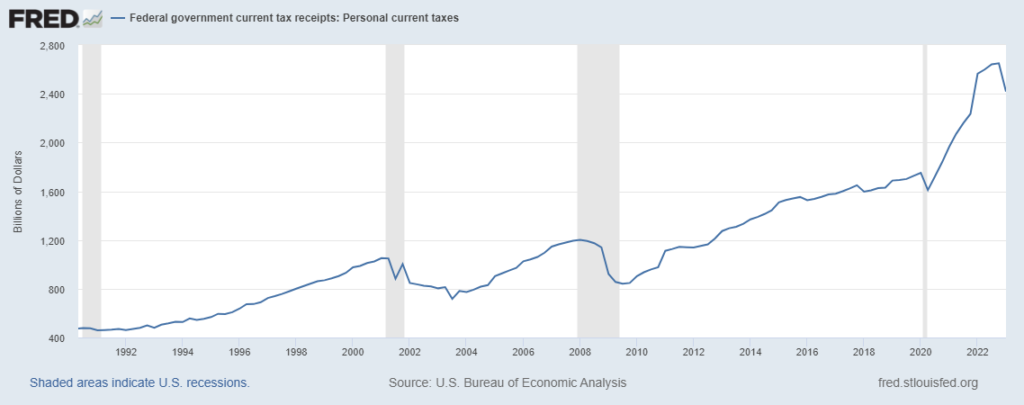

At current tax rates the Federal income taxes collected in 2023 are projected to be $2.63 trillion (Take a look at the chart below). That means that 47% of every personal income tax dollar is spent on the interest on the national debt. It is this author’s opinion that the only viable way to reduce the deficit would be to simultaneously raise taxes and lower spending. And as they say in North Carolina, that dog won’t hunt.

Now that we have established the precarious position of the US Treasury, we must entrust our elected officials to come to their respective senses and permanently eliminate the debt ceiling, just like every other country in the world. Clearly this is a mere pipe dream, and I assure you I have not been smoking anything hallucinogenic lately. For now, I will amend my humble request and ask our elected officials to come to a simple agreement to ensure that the US never defaults on its debt obligations. That is all they would have to do to show much needed support to all investors – just promise to pay your dang bills on time.

Analysts often overcomplicate economic concepts, relying on highly ambiguous explanations and potential solutions to crisis management. But for me the solution to the debt limit crisis is far more simple – if the US government made a proclamation that our country will NEVER default on a payment the entire financial world would be a much safer place to reside. Interest rate volatility would subside, stock markets would take a collective breath of relief, and individuals and companies would be able to manage their cash flows more efficiently.

So here we stand, waiting for President Biden and a split Congress to come to a bipartisan agreement. And this time, it matters. Apparently, the main players will all meet on May 9th at the White House to try to resolve the impasse. If I was a betting man, I would count on the meeting going horribly wrong. First meetings generally end poorly when the two sides disagree on everything. It will take a good scare to get our elected officials to see through their needs to score political points and instead govern us effectively. But in the end, I expect them to find a path forward and raise the debt ceiling. I suspect that the markets might get a little bumpy along the way. Once this is past us, we can start paying attention to the next US Presidential election. The first Republican debate is scheduled for August 2023 – just three months from now. I bet you didn’t think that was coming so soon.

Pretty simple, huh?