Every so often I find it useful to review recent history to gain some perspective on how markets may react in the near future. I find it relevant to go through this process right now as I think it will shed light as to where we currently stand economically and how the path of policy may effect our portfolios. If you bear with me I think we may be able to come to some interesting conclusions by the end of this article.

In 2021 it became evident that the US was having a serious bout of inflation, the likes of which we have not witnessed since the 1970s and 80s. After decades of low and stable prices, an unprecedented fiscal and monetary stimulus was administered due to the need to stave off the effects of a Pandemic closure. Were it not for the rapid and coordinated response of the US authorities, we would most certainly have experienced a protracted economic contraction of historical magnitude, threatening the job security of millions of Americans and potentially bankrupting a large portion of otherwise viable businesses. In March 2020, at the onset of the Pandemic, the Federal Reserve slashed interest rates to zero percent and initiated a massive quantitative easing campaign to support collapsing credit markets. The economy would contract nearly 32% within weeks and the Fed assured the globe that they were there to support markets at any and all costs. Additionally, the US Treasury recommended deficit funded spending programs to arrest the process of mass layoffs, providing loan forgiveness programs to incentivize employers to maintain their payroll levels while the economy recovered from the sudden shutdown. The economy was saved from near ruin by a quick acting central bank combined with a targeted payroll funding scheme named the PPP. The US economy responded with extraordinary vigor and rose almost as rapidly as it had contracted, and by the end of 2020 had recovered nearly completely from the Pandemic.

By early 2021, the unemployment rate had dropped from 14.7% to 6.4% and was poised to continue to fall as vaccines became readily available and workers began returning to their jobs. Driven by a resounding electoral victory, the Biden administration quickly enacted additional stimulus programs which would cement the recovery, passing an economic plan that would literally pay people living wages while they awaited a full reopening of school systems and a proliferation of vaccination programs. In some cases, the newly unemployed were paid more money to stay at home than their previous jobs provided to them. For many employees it was uneconomical to return to work while schools were still shuttered due to Pandemic risks and they were forced to keep their children at home awaiting school reopening. The reopening of a shuttered economy proved to be a highly complex process, awash with unpredictability and supply chain disruptions. While the economy was coming back online, people had been given stimulus checks that were dropped into their banks accounts – and they began to spend them. They spent them on new computers, and automobiles, and homes, and furniture, and eventually airline tickets and new experiences. Even though manufacturers were still sorting out the supply chain issues of a highly complicated and integrated global economy, people spent their checks in record amounts. Companies had to expand production capacities to meet the massive demand. Since workers had dropped out of the workforce, it became necessary for employers to offer higher wages to attract workers to return to their posts. We had entered a period of excess demand at the same time that we were experiencing labor shortages and supply chain disruptions. It became very clear that this supply/demand imbalance would translate to a rapid inflationary cycle.

For the first nine months of 2021, the Federal Reserve had become somewhat comfortable with a hypothesis that inflation was mostly being caused by supply chain disruptions, and once those supply chains were back up and running the inflation would prove to be “transitory.” At the same time, President Biden’s closest economic advisors, including longtime academic and former Federal Reserve Chair Janet Yellen were convincing the new administration that more stimulus was necessary to bridge the gap for the many left behind during the onset of the recovery. But in classic egalitarian fashion, the new spending programs would provide stimulus to all, most of which was completely unnecessary. In a word, the Fed and the Treasury got it utterly wrong. While the economy was overheating, they continued to add stimulus and thus created a self feeding inflationary cycle. People received more stimulus money, they then spent that money, and companies had to increase hiring to meet the new demand. But since there weren’t enough people to fill those job vacancies, wages began to rise, thereby providing even more money into the economy which fueled even more spending. The perfect inflationary storm had arrived. The Fed and the Treasury had added massive amounts of long lasting fuel to a raging inflationary inferno.

In late 2021, the Federal Reserve had come to realize that the “transitory” nature of inflation was not very transitory after all. On December 15, 2021, Chairman Powell informed the public that the Fed had learned that inflation was now a serious problem and that he viewed that given the lack of control over the supply side of the economy the only manner to attack the inflationary cycle was to lower the demand for goods and services. That is fancy speak for slowing down the economy. Powell was informing the public that the Fed was ready to act to lower demand by raising interest rates and reducing the size of its balance sheet (or embarking on quantitative tightening). It would be another three months before the Fed would actually begin the hiking campaign that would culminate in the fastest pace of monetary tightening since the early 1980s. Even though we are not yet complete with the interest rate rises, it has become somewhat obvious that the full brunt of this historic and relentless attack on the risk free rate of interest will have a meaningful impact in the first half of 2023. Housing activity has collapsed, auto purchases have slowed down, and retail sales for everything from computers to TVs and apparel have begun to roll over. The only data that has yet to react is the jobs data as employment continues to expand even in the face of ominous economic headwinds. On the back of the slowing economy I reckon that the Fed is mostly done with the brunt of the heavy lifting, having raised rates by 4.25% in just nine months. Given that Chair Powell has informed us that the labor market remains too tight, I suspect that they will continue to increase rates gradually over the next three meetings to 4.75% – 5.25% and then wait for the proof that they have successfully lowered the pace of GDP and inflation. The experience of the 1970s and 80s has inspired the Federal Reserve to do anything in its power to avoid a historic repeat. For now it appears that the Fed will remain moderately restrictive for some time. But it is my opinion that if they begin to see unemployment rise they will stand ready to reverse course as they have so many times before. Talking tough on inflation is easy when employment is rapidly expanding. But when people start losing jobs it is a far more difficult sell to the public.

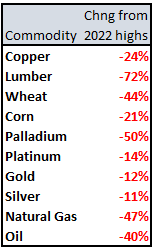

By now you are pretty eager to learn what this all might mean for our collective portfolios. 2022 has been a complete bust for nearly every asset class. Commodities have collapsed, as you can see by the following data set which measures current prices from the highs earlier this year:

Commodities serve as a major input into the Producer Price Index (“PPI”) which measures prices at every stage of production. PPI has strong correlation with the Consumer Price Index (“CPI”) and the Personal Consumption Expenditure Index (“PCE”) which the Federal Reserve targets as their preferred inflation metric. The commodity space has burst and the bubble is now gone. Part of this is due to supply chains finally coming back online. The other part is an expectation for much slower consumer spending moving forward.

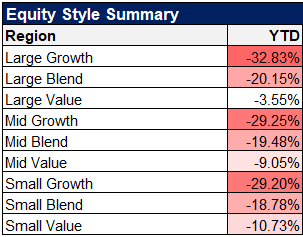

We all know that growth stocks have suffered large losses in 2022 as interest rates have dented them a bit more forcefully than other sectors. But even blended portfolios have gotten clobbered this year. See below for the current 2022 returns on various equity market returns:

As I have repeatedly written over the last several years, when the Federal Reserve is forcefully raising interest rates and pulling liquidity they will succeed in slowing down the economy. When investors perceive that the Fed might cause a lasting recession stock markets tend to perform poorly – this has been the story of 2022. But the key to understanding the 2023 story is earnings. If the Fed were to manufacture a meaningful recession companies will have less revenues and thereby less earnings. For now, we must continue to take Chair Powell at his word and expect the central bank to deliver on its promise to cause an uncomfortable contraction. But the alternative of high inflation is far more detrimental to long term growth. The aggressive Fed has all but assured us that inflation will be in our rear view mirror at some point in the next six months. That is exactly why the time to consider to add to equity exposures is towards the end of the hiking cycle and the start of the edges of a recession.

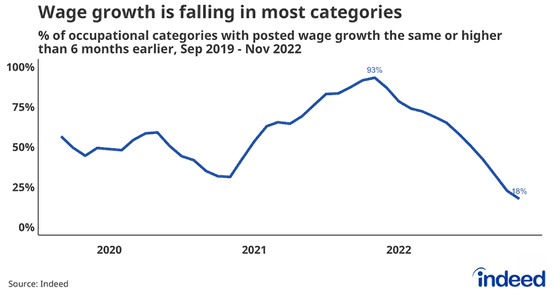

One final point: as input prices begin to fall, corporate profits may be able to expand as margins could increase. The biggest price input is the cost of labor – we are already seeing wages peaking and beginning to come down. Thanks to our friends at “The Daily Shot”, take a look at this graph for posted wages over the last three years. It shows that wage pressure has nearly vanished over the last six months:

If we finally begin to see a measured slowdown in hiring, corporate margins might once again be protected. 2023 should be a classic earnings led year for stocks. What we as investors must do is have a good understanding of how earnings will shape out once the Federal Reserve has completed the hiking cycle. My bet is that US companies will be well positioned for the growth phase of late 2023 and into 2024. Either way it should be setting up for an eventful 2023.

Happy New Year to all and a Merry Whatever Holiday You Celebrate!